Understanding Rental Yields in Dubai: A Comprehensive Guide

Investing in Dubai's real estate market can be highly lucrative, but understanding rental yields is crucial for making informed decisions. Our Dubai property rental yield calculator by area helps you analyze potential returns across different neighborhoods.

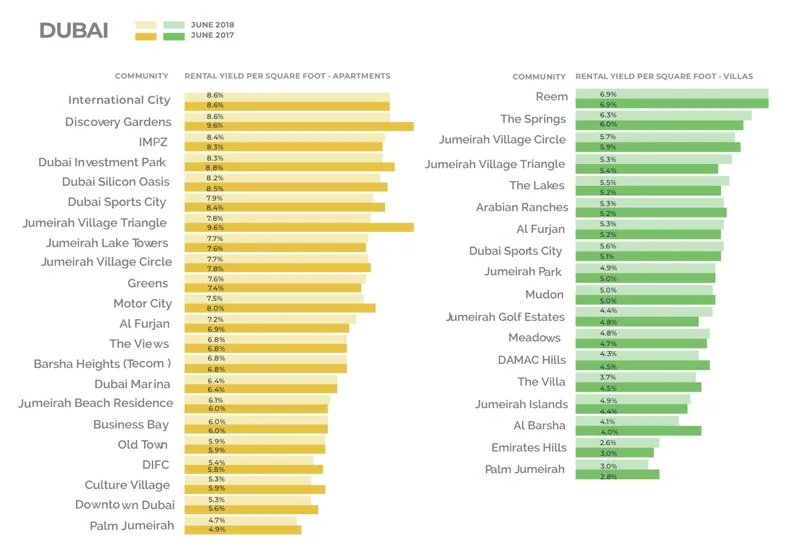

Average Rental Yields in Dubai by Area (2023)

Visual representation of top performing areas for rental yields

📊 Image Credit: Property Finder

What is Rental Yield?

Rental yield is a key metric that measures the annual rental income as a percentage of the property's value. It helps investors compare different properties and locations. There are two main types:

- Gross Rental Yield: Annual rental income divided by property price

- Net Rental Yield: (Annual rental income - expenses) divided by property price

Dubai Rental Yield Trends

According to recent data from Dubai Land Department, average rental yields in Dubai range between 5-8%, with some areas performing significantly better.

| Area | Average Gross Yield | Average Net Yield | Price per SqFt (AED) |

|---|---|---|---|

| Downtown Dubai | 5.2% | 4.1% | 1,800 |

| Dubai Marina | 6.1% | 4.8% | 1,450 |

| Jumeirah Village Circle | 7.3% | 6.2% | 950 |

| International City | 8.5% | 7.1% | 650 |

| Palm Jumeirah | 4.8% | 3.9% | 2,200 |

Factors Affecting Rental Yields in Dubai

Several factors influence rental yields in Dubai's property market:

- Location: Proximity to business hubs, beaches, and amenities

- Property Type: Apartments typically offer higher yields than villas

- Furnishing: Furnished properties command higher rents

- Community Facilities: Pools, gyms, and security can increase rental value

- Market Conditions: Supply and demand fluctuations affect rental prices

Maximizing Your Rental Yield in Dubai

Here are some expert tips to improve your property's rental yield:

- Target the right tenant demographic: Different areas attract different tenants (families, professionals, students)

- Optimize your pricing: Use our rental yield calculator to find the sweet spot

- Minimize vacancies: Offer competitive rates and flexible terms during slow periods

- Reduce operating costs: Negotiate service charges and maintenance contracts

- Add value: Small upgrades can significantly increase rental income

Commercial vs Residential Rental Yields

Commercial properties in Dubai often offer higher yields but come with different considerations:

| Factor | Residential | Commercial |

|---|---|---|

| Average Yield | 5-8% | 7-10% |

| Lease Length | 1-2 years | 3-5 years |

| Tenant Turnover | Higher | Lower |

| Maintenance Costs | Tenant often covers | Landlord often covers |

| Vacancy Risk | Moderate | Higher |

Risks and Considerations

While Dubai offers attractive rental yields, investors should be aware of potential risks:

- Market fluctuations: Rental prices can vary significantly with economic conditions

- Regulatory changes: Stay updated on tenancy laws and visa regulations

- Hidden costs: Service charges can significantly impact net yields

- Currency risk: For foreign investors, exchange rate fluctuations matter

FAQs About Rental Yields in Dubai

A net yield of 5-7% is generally considered good in Dubai, with some areas offering higher returns. Our calculator helps you compare different locations.

Areas like International City, Jumeirah Village Circle, and Discovery Gardens typically offer higher yields, while premium locations like Palm Jumeirah have lower yields but better capital appreciation.

Dubai offers higher average yields than many global cities like London (3-4%), New York (3-5%), or Hong Kong (2-3%), making it attractive for income-focused investors.

Net yield is more important as it accounts for all expenses. Our calculator helps you determine both metrics for accurate comparisons.

At least annually, or whenever market conditions change significantly. Save your calculations using our tool to track performance over time.

Rental yield measures annual income relative to property value, while ROI (Return on Investment) considers total profit over the investment period including capital appreciation.

Studios and 1-bed apartments often have higher yields than larger units. Commercial properties typically offer higher yields than residential but with different risk profiles.

Include all costs: service charges, maintenance, insurance, property management fees, vacancy allowance, and any other recurring expenses.

Dubai generally offers higher rental yields than Abu Dhabi, with more diverse tenant demographics and a larger expat population driving demand.

Short-term rentals can significantly increase yields but come with higher management costs, regulatory considerations, and greater vacancy risk.

Related Tools

For more insights on Dubai's property market, visit Dubai Land Department or read market reports from CBRE and JLL.